3 min read

A Year with "The Trading Mindwheel": Transforming Trading Through Psychology

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

Forex traders can choose from a variety of currencies and it’s very easy to get lost as a new Forex trader. In this article, we take a close look at the 6 Forex major pairs, what you need to know about Forex rates movements and how to trade the Forex majors.

The table below shows the 6 Forex major pairs, ranked by daily average price movements. We’ll take a closer look at each Forex major and then provide some practical tips on how to trade the Forex majors later on.

| Pair | Currencies | Average Daily Pips |

| British Pound / US-Dollar | 125 | |

| US-Dollar / Japanese Yen | 120 | |

| US-Dollar / Canadian Dollar | 110 | |

| Australian Dollar / US-Dollar | 70 | |

| Euro / US-Dollar | 60 | |

| US-Dollar / Swiss Franc | 60 |

In currency trading, traders use pips (points in percentage) to measure distances in Forex rates. The information we get from pips can also be used to analyze risk and size positions. If your trading account is denominated in USD, the table below shows the value of 1 pip depending on the lot size of your trades.

|

Forex Pair |

Pip-value standard lot |

Pip-value

mini lot |

Pip-value micro lot |

| 10.00 | 1.00 | 0.100 | |

| 9.20 | 0.92 | 0.092 | |

| U |

7.70 | 0.77 | 0.070 |

| 10.0 | 1.00 | 0.100 | |

| 10.00 | 1.00 | 0.100 | |

| 10.30 | 1.03 | 0.103 |

Those values change slightly based on the actual exchange rates, but the fluctuations are very minor.

Especially when you are a new Forex trader, it’s advisable to stick to those 6 currency majors. The Forex majors are usually more liquid and also have a smaller bid/ask spread which make them attractive for Forex traders. Furthermore, the price movements are often more reliable and volatility can be lower – of course, this comes with exceptions and volatility can spike at times.

The EUR/USD is the most popular Forex pair; the Euro area and the US are the two largest economies worldwide and, thus, the EUR/USD attracts a variety of investors and traders alike.

Another interesting characteristic of the EUR/USD pair is that the overlap between the European and US trading session (for more on this topic see below) is the most active Forex trading session and volatility and momentum are often very high during those times. This makes trading the EUR/USD very attractive since wider swings often equate into more trading opportunities.

The US-Dollar has also a unique role in the Forex markets because it’s the world’s reserve currency and it’s used to settle most international transactions; hence, the US-Dollar is the world’s most traded currency. Furthermore, commodities are usually priced in US-Dollars which also influences the status of the US-Dollar.

| Rank | Issue currency | Turnover |

| 1 | 869,622 | |

| 2 | 249,976 | |

| 3 | 92,004 | |

| 4 | 84,030 | |

| 5 | 39,895 | |

| 6 | 39,539 | |

| 7 | 24,097 |

Exchange-traded futures, by currency

The USD/JPY has an interesting role in the Forex markets because the Yen is seen as a so-called ‘safe haven’ investment. This means that in times of uncertainty and market turmoil, investors shift from trading riskier assets such as single stocks to trading the Yen and other ‘less risky’ instruments.

However, those safe-haven flows have led to a major price increase in the Yen and since the Japanese economy depends on a cheap Yen to boost their exports, the Bank of Japan has stepped in repeatedly, trying to bring down the Yen. This lead to huge volatility in the Forex rates and it’s something Yen traders need to be aware of.

The GBP/USD is the biggest mover among the Forex majors with the highest largest daily pip range which attracts many traders. The GBP/USD is a very popular Forex pair among traders, although its sudden and wild price movements can easily catch you on the wrong foot. Proper risk control and a stable mindset are very important when trading the GBP/USD.

With the recent uncertainty in the Euro area and the talk about the Brexit, the GBP/USD has become even more volatile and unpredictable. The GBP/USD has a very high correlation to the USD-Index and it correlates very little to other markets. It’s also considered more of a technical pair, responding nicely to technical analysis.

Fun fact: The nickname of the GBP/USD is “Cable” because the Forex rates for this currency pair were wired between the UK and US via underwater cable back in the days.

The CHF is the second safe haven currency because the Swiss economy and the Swiss currency is considered relatively stable. Similarly to the Japanese Yen, the Swiss Franc also rises during times of uncertainty. However, the Swiss National Bank is also trying to keep the currency rate low and has intervened in the currency markets frequently which has led to major volatility and price spikes.

The high negative correlation between the USD/CHF and the price of Gold is important to pay attention to as a Forex trader. The correlation exists mainly because both Gold and the Swiss Franc are considered safe haven assets and rise together in times of market turmoil.

The Australian Dollar (AUD) and the Canadian Dollar (CAD) are two so-called commodity currencies and are highly correlated to commodity prices.

Australia is a major Gold producer and Gold exporter and the Australian economy depends on the price of Gold. Thus, the AUD/USD and Gold have a very high correlation and Forex traders active in the AUD/USD should always keep an eye on the price of Gold because technical signals often happen simultaneously.

Canada is a major oil producer and Oil exporter. Thus, the Canadian economy is affected by fluctuating oil prices and the Canadian Dollar (CAD) is closely linked to the price of oil. If you trade the USD/CAD currency pair, it’s important to keep track of the price of crude oil as well since currency moves and oil price movements often happen together. The chart below shows that the correlation at the bottom is usually close to -1 which is an extreme.

If you are a Forex trader trading USD related pairs, I highly recommend keeping an eye on the USD-Index. The USD-Index usually sets the tone for a lot of currency moves and it can help your price analysis and your trade timing to be aware of developments on the USD-Index.

The screenshot below shows a recent example where the USD-Index on the left showed a false breakout and a bounce off support – simultaneously, the USD/CAD showed a textbook long entry at the exact same time.

Although the Forex market is open 24 hours a day from the time the Sidney stock exchange opens Monday morning until Friday night when New York closes, it’s still important to keep track of individual trading session as they impact Forex rates and volatility significantly.

The table below shows how global trading sessions spread throughout a regular 24-hour cycle. First, it’s important to understand that currencies move most when their local market is open: the Australian Dollar moves most when Sidney is open, the Euro is most active during the European (Frankfurt and London) trading session, and so on. Generally, the most active trading session is where New York and London overlap.

This unique characteristic in the Forex market impacts trading decisions on multiple levels:

1) Market selection

If you are a day trader, you should choose Forex pairs that are most active during the times when you sit in front of your charts. Choosing pairs that are not active during your trading can easily suck you in low volatility and boring price moves.

2) Active trading decisions, entries and exits

When you are in a trade, make sure to analyze price in context to the current trading session and then make your decisions accordingly. For example, if you are in an EUR/USD trade, but price isn’t going anywhere during the Asian trading sessions, it does not have to mean that your trade idea is invalid – it’s more likely that your market is just not active as European and US traders are not there to move the market.

3) Breakouts during active session

This ties in with the previous point. A breakout that occurs during a pair’s actual trading session is much more likely to succeed. This also holds true for the creation of new trends. A breakout and sudden high momentum move in the EUR/CAD that happens during the US session is usually more meaningful as more traders and investors are behind the move.

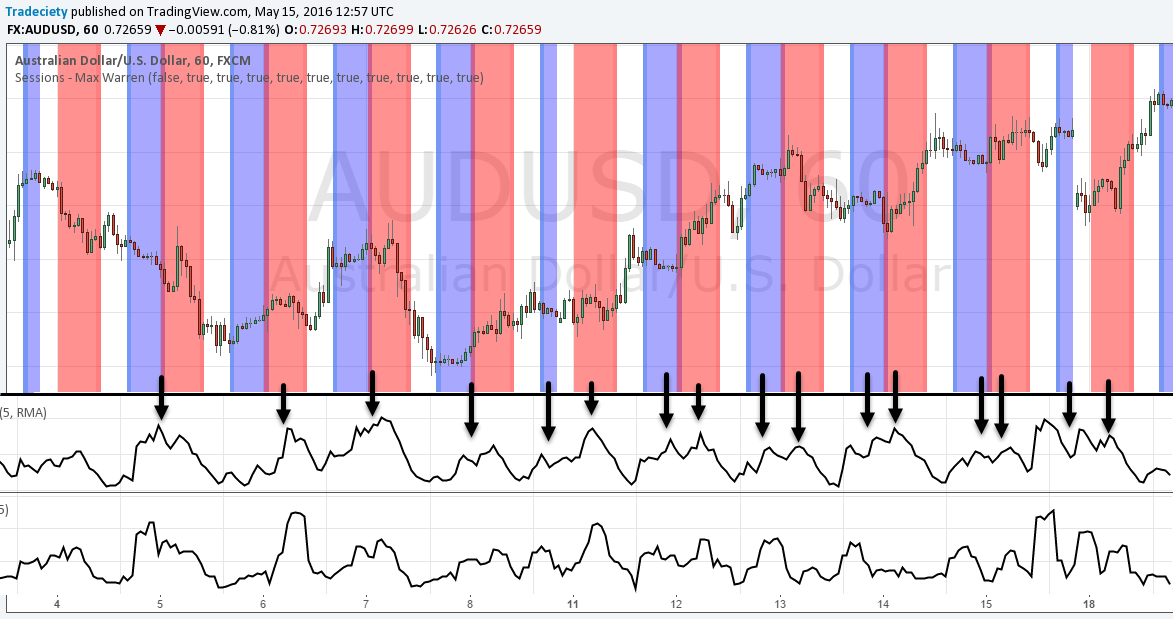

The screenshot below shows the rhythm of the currency markets and how Forex rates are influenced by local trading sessions. The price chart shows the AUD/USD and at the bottom you see the ATR (momentum) and a volatility indicator. It’s obvious how the indicators peak during the US and Australian trading sessions.

Financial markets are interwoven and highly interconnected. The Forex market in particular and the fact that Forex rates are quoted and traded in pairs make correlations a very important topic in trading. The table shows the correlation between the individual Forex majors.

Quick correlation recap: A positive correlation between two Forex pairs means that the pairs move into the same direction; a negative correlation means that prices move into opposite directions. The maximum correlation numbers are +1 and -1. The higher the number, the more similar the currency pairs move.

1) Risk

It’s essential to understand that when you enter a trade on two currency pairs with a high positive correlation, you are increasing your risk as both pairs are moving very similarly. So you have a high likelihood of either having 2 winners or 2 losses at the same time.

2) Pair selection

When you have a potential setup on two positively correlated pairs, you have two options: first, you can enter a trade on both pairs but reduce your individual position size to avoid excessive risk taking. Or second, you can choose between the two pairs and pick the one with the better-looking setup.

Forex trading can be quite complex, especially for new traders. If you want to get a head start, you should focus on the 6 Forex majors first, get a good feeling for how they move and what influences forex rates movements and then slowly develop expertise for those markets.

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

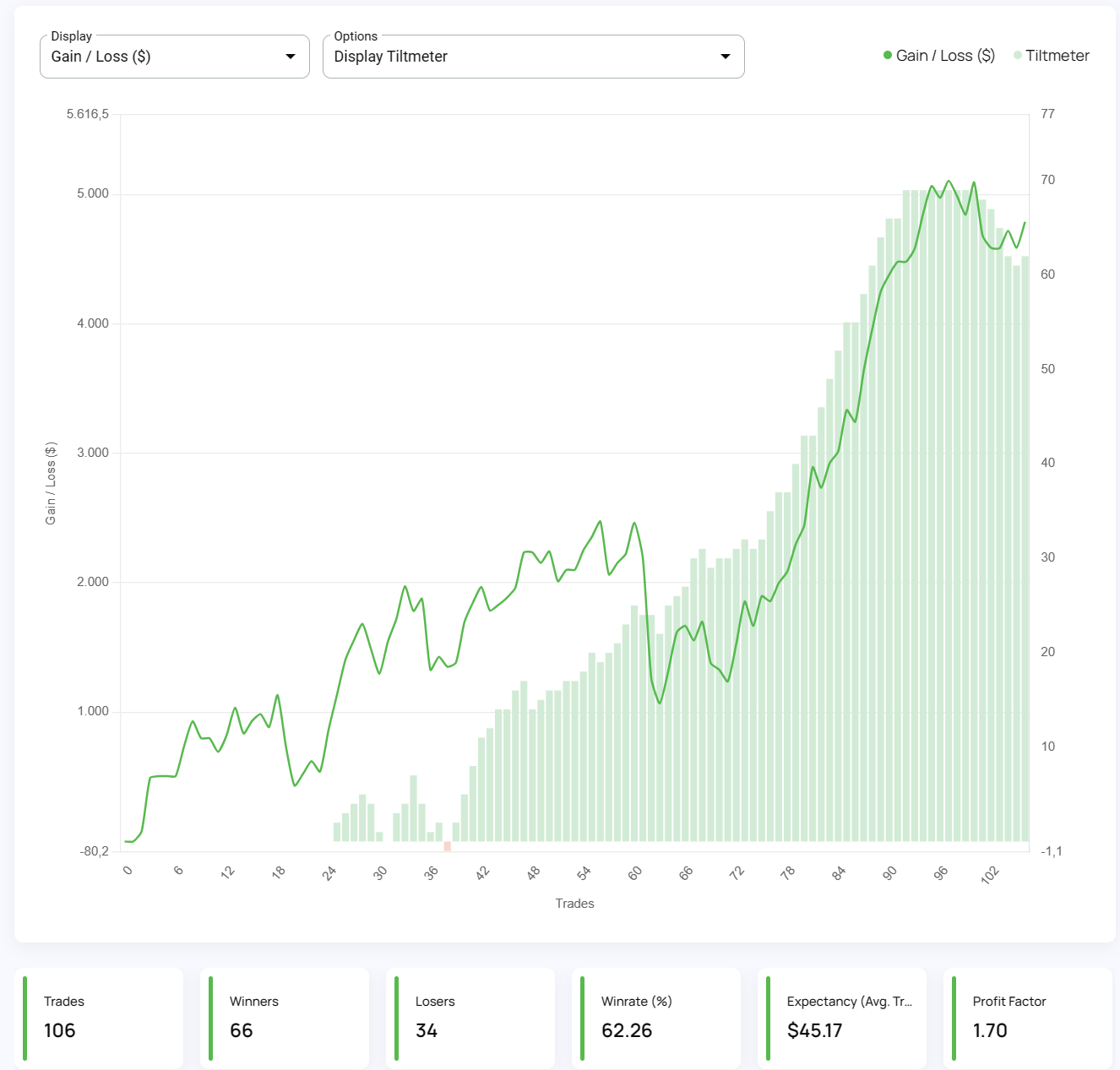

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...

8 min read

Dive deep into the world of finance and high-stakes trading with this selection of movies and documentaries! From the exhilarating thrill of...