3 min read

A Year with "The Trading Mindwheel": Transforming Trading Through Psychology

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

Rolf

Nov 10, 2015 7:00:00 PM

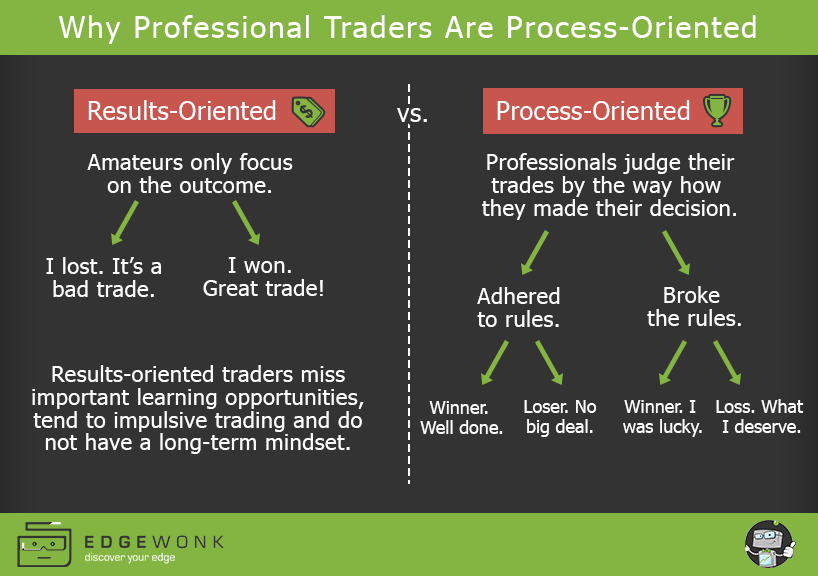

There is a big difference between the average losing and the average winning trader, and the difference does not lie in the way they choose their indicators or how they define entry signals. Professional and consistently winning traders have a unique mindset that allows them to evaluate and understand their performance on the most efficient level. On the other hand, consistently losing traders all share the same mindset; how amateurs look at their daily trading and how they judge their performance is distinctly different from the professionals. In the following article we show you the unique differences between professional and amateur thinking and how you can adopt a winning, process-oriented mindset.

Amateur traders judge their whole performance based on only one metric: money. As long as they have a positive performance, everything is fine. Amateur traders have a binary mindset: if their trade is a winner, they believe that their trade was good and if they have a loss, they must have done something wrong.

click to enlarge – image credit: Edgewonk.com

For traders who only judge their abilities based on the outcome of their trades, it is almost impossible to escape the losing mentality and make money in trading. If you believe, after a losing trade, that your trade was bad, that you did something wrong or that your system “is not working”, you are more likely to constantly make changes about your system and trading method. Although most traders know that they can’t win all their trades, amateurs still attribute losses to a “flaw in their system” and change from method to method and follow the path of “system hopping”. These are the traders, who after years, still look like beginners and are still searching for the Holy Grail.

Professionals understand and, even more important, internalize that the outcome of a trade is not in their hands. Once they have done their duty, created a trading plan, researched their trading idea and waited patiently for all signals to align, they know that there is nothing else that they can do and that, upon entering a trade, they have to accept the randomness of the results.

Professionals know that over the long-term, they will come out ahead if they follow their principles and rules and that, in the short-term, anything can happen. Therefore, they don’t see losses as something bad or something to worry about. As long as they haven’t done anything wrong, professional traders do not see a difference between losing and winning trades.

Process-oriented thinking is defined by the ability to trade and act completely detached from the outcome; professionals only evaluate their actions and behavior based on how well they have executed their trades.

There are certain concepts and characteristics that professional traders live by and which enable them to trade without emotional pressure and almost completely detached from psychological influence:

Wisdom is only of value if it is followed by actions. To improve the way you approach trading and look at your performance, you have to actively monitor yourself. Pay close attention to how you react to losses and wins. Does a loss make you want to change something? Do you always look for reasons why a trade might have failed? And do you get too excited about winning trades, even though you broke your rules?

Awareness is only the first step. Once you have identified flaws in your thought process, you have to correct them. Keeping track of your performance and, even more important, how your trades come about is vital for the future improvement as a trader. You should stay away from system hopping and start judging your performance based on your actions, rather than only by your P&L. The money will follow once you unlearn the amateurish mindset.

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...

8 min read

Dive deep into the world of finance and high-stakes trading with this selection of movies and documentaries! From the exhilarating thrill of...