3 min read

A Year with "The Trading Mindwheel": Transforming Trading Through Psychology

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

4 min read

Rolf

Jun 5, 2016 8:00:00 PM

Every trader knows that you have to trust your system if you want to trade profitably. But trusting a method that you haven’t fully tested yet and no real experience with is an impossible task. It’s the chicken and egg problem in trading: without trust, you can’t execute your trades correctly – without executing your trades correctly, you can’t gain trust because your results won’t be consistent and profitable.

Not trusting your own system is a huge dilemma in trading and it’s one of the biggest problems that new traders have to deal with. You have to trade with confidence and execute your trades without doubt, hesitation and second-guessing. Otherwise, trading is mere gambling.

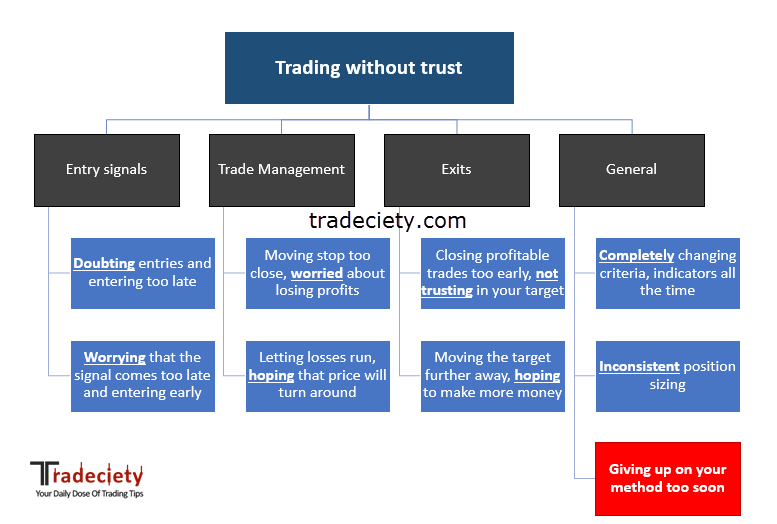

If you have been trading for a while, I am sure that you have come across the problems below which describe what happens when you don’t trust your trading method:

We mentioned it before: without confidence, you can’t execute your trades correctly and trade profitably, but you can’t gain confidence if you keep losing money either. So what’s the way out and how can you still improve your trading even if you neither have confidence and also lack the positive results?

click to enlarge

If you have been hoping for a secret tip, I have to disappoint you. There are no shortcuts that will suddenly eliminate all your doubts and make you a better trade.

You have to realize that, at the beginning, your results won’t be what you imaged them to be. How do you get better at anything? You start at the bottom, you throw yourself into it and become better over time, while acknowledging that you will lose (a lot, potentially) at first. This is not only true for trading, but for all skills and things you start, but traders often like to forget this principle.

At the same time, you make a conscious commitment to the process and detach yourself from the outcome – you don’t care how much you win or lose, as long as you improve and become better.

“Every master was once a disaster” – T Harv Eker

If you are trading with a system you don’t really know yet, it’s natural to experience fear of the unknown and, thus, uncertainty. It can’t be any other way. You have to understand that this is a normal process and you can’t eliminate fear just by making a conscious decision.

However, you can create processes around your trading approach and methodology that can help you eliminate some of the uncertainty and provide guidance. In the next paragraph, we will talk about the importance of having rules and how they can help you make the next step.

This is especially important if you use someone else’s trading method. No matter how great the promised and advertised winrate is, you have to make your own experiences with to gain trust.

Fear comes from uncertainty; we can eliminate the fear within us when we know ourselves better. – Bruce Lee

I am obsessed with rules and creating a repeatable trading approach because I have seen first-hand how much of a difference having rules can make. There are two reasons why traders should have rules:

1) A trader who has rules and guidelines that control his actions is more likely to execute his trades in the same (or similar at least) way.

2) It makes analyzing past performance effective because you can analyze objectively (without all the noise from taking random trades) how certain things are performing and what works best.

On the other hand, if you are a trader who is not following a standardized method and who has no rules, you will always be left wondering and doubting what is causing your failures.

There are two reasons why airplanes are the safest mode of transportation:

1) Airlines are looking to make small, but consistent improvements

Airlines and airplane manufacturers are not trying to experiment with radical changes in the way they operate – quite the opposite. They are looking for safe ways to make small and steady improvement to their current processes and approaches. Over the long-term, they know that as long as they keep improving (no matter how fast), they will become better eventually.

In trading, you have to stop following the dream of the Holy Grail system that will suddenly double your account year after year. Instead, focus on making small, but steady improvements and tackle your weaknesses one by one.

Most traders believe that they have to completely change their method and trading system all the time. This is the biggest mistake you can make and it’s a guarantee that you will fail forever if you keep changing your approach radically.

2) They believe in the power of checklists

When it comes to airplanes and airlines, you’ll find a standard operating procedure and checklists for everything. It may take away some flexibility, but it reduces the potential for errors significantly.

Here is a great example from an airline manufacturer’s press release which highlights the importance of having checklists:

The rationale for checklists is not an issue of aptitude, but the realization that complex activities can overwhelm. Professionals who have skill, knowledge and experience are making mistakes, despite their expertise. …

“A good checklist is precise and lists only critical steps in a concise way, […] They must be easy to use even in difficult and stressful situations.” 1

In another study done in hospitals around the world, researchers found that major complications for surgical patients decreased by 36 percent after the introduction of checklists. Deaths fell by 47 percent.2

Why is it that traders think that they are better and don’t need all those things that could very likely help them become better? So much in your trading could be standardized and optimized, and utilizing a checklist is probably the easiest way to improve your trading. Furthermore, it will eliminate so much of your inconsistent results that you can see much clearer how you approach your trading.

Even market Wizard Marty Schwartz said that he still uses physical checklist before entering a trade. Do you really think that you are so good that you can go without it?

Whenever new traders ask me how they can eliminate doubt and fear, I give them the exact same advice: start collecting 3 screenshots for every trade:

1) The entry

Have you taken trades based on your rules?

2) The exit

Emotional vs reasonable exit?

3) A few hours (days if you are a swing trader) after your exit

Is there more profit potential? Do you take profits too early or too late?

This way you’ll quickly be able to analyze you how well you manage your trades, how good you are at picking exits and whether or not you should let your trades run. It’s the easiest and most efficient way to reduce doubt and get to learn your trading system and behavior better.

You don’t have to get too fancy in the beginning when your own goal should be understanding your method and yourself as a trader better. With time and expertise, you can then move on to more advanced forms of record keeping and journaling.

Audit yourself and ask yourself how big of a problem a lack of confidence and trust is in your trading. Most traders will quickly see that the majority of their mistakes and misbehavior stems from a lack of trust.

References

1) http://www.boeing.com/news/frontiers/archive/2010/october/i_bca05.pdf

2) http://www.nature.com/news/hospital-checklists-are-meant-to-save-lives-so-why-do-they-often-fail-1.18057

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...

8 min read

Dive deep into the world of finance and high-stakes trading with this selection of movies and documentaries! From the exhilarating thrill of...