3 min read

A Year with "The Trading Mindwheel": Transforming Trading Through Psychology

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

Not through picking the right entry method or a ‘better’ combination of indicators you will achieve your trading goals, but through risk management and position sizing you can, to some degree, control and manipulate your trading objectives. The goals of traders can be summarized with the three following points:

Usually, risk -seeking traders, or people with a gambling mindset will exclusively look for achieving a high percentage gain to grow their accounts fast, while often neglecting the importance of controlling drawdowns and managing risk properly. Thus, traders who are mainly looking for more profits often end up losing the most. Related article: Who loses the most in trading?

Risk-averse traders are mostly concerned about keeping drawdowns small and avoiding major swings in their account balance.

The advanced traders try to control both previous points to maximize their gains while keeping drawdowns relatively small. Although this sounds like something that is very hard to achieve, there are two trading concepts that allow you to actively control the degree to which your trading account balance will likely grow and also how impactful drawdowns can be.

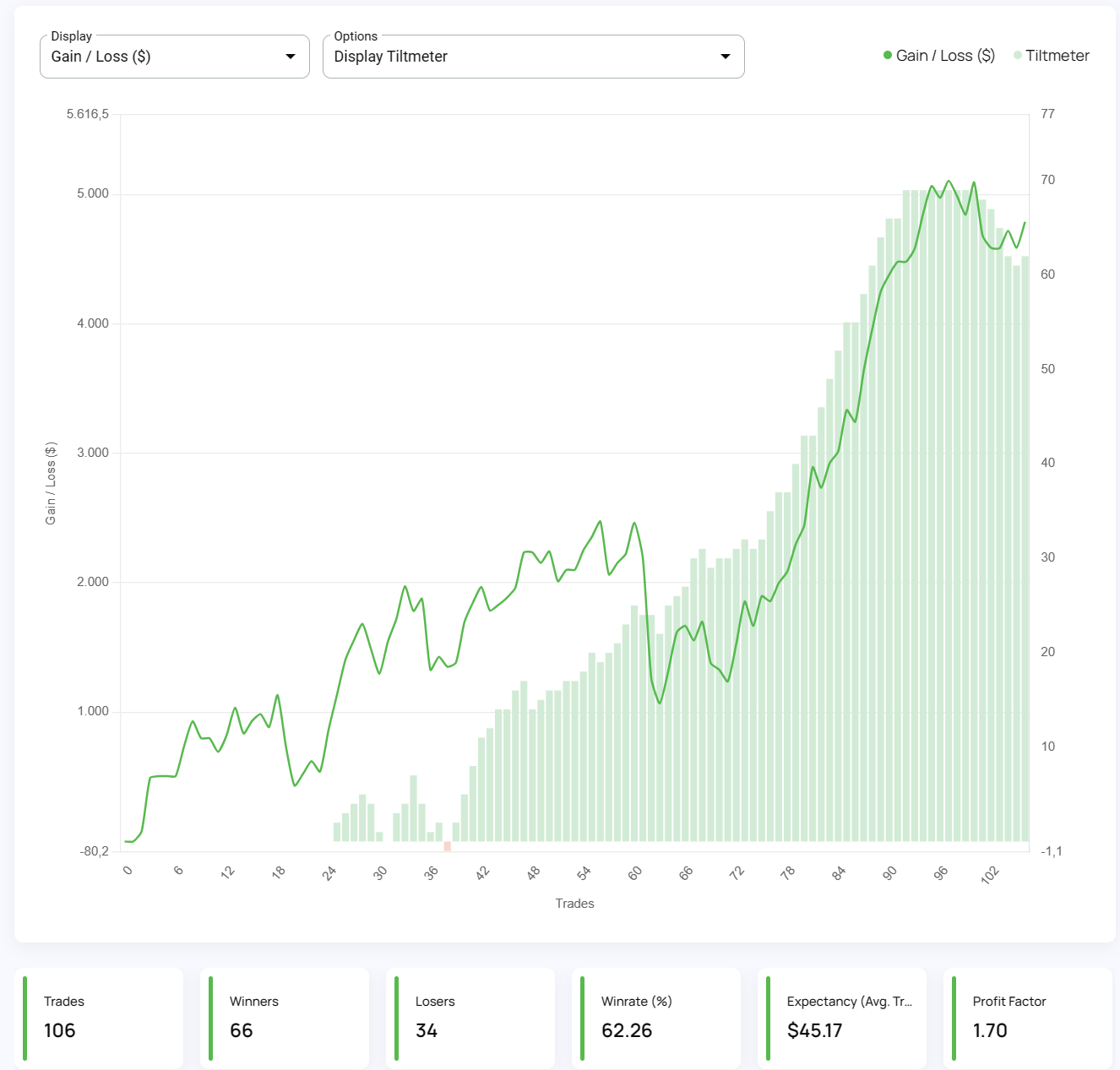

Winrate and position size are two trading concepts that are often not fully understood and most traders do not completely understand the impacts of the two figures and how they shape a trader’s destiny.

Winrate is the figure that traders cannot influence and although winrate is backwards looking, it can provide meaningful insights about the potential performance of a trader.

Winrate = Likelihood of winners, losers and size of drawdowns

The lower your winrate, the more frequently losing trades you will have and, consequently, the higher your drawdowns will be.

Just think about it with a very basic example: over the course of 200 trades, the statistical difference between a trading strategy with a winrate of 50% and one with 60% will be roughly 20 losing trades (100 losing trades with a 50% winrate and 80 losing trades with 60% winrate).

Furthermore, the lower your winrate, the more likely it is that losing streaks will be longer. These two points lead us to how position sizing fits into the picture and how it can help traders to improve their risk management.

In contrast to the concept of winrate, traders can actively manage and control position size. Although this sounds like a very trivial insight, the implications are huge:

Let’s get back to the example with the two trading strategies. The first one has a winrate of 50% and the other one 60%. As we have said, the one with 50% will have roughly 20 more losing trades over the course of 200 trades.

If you use 1% position size (risking 1% of your total capital on each trade) on both strategies, you will see a (roughly) 20% higher drawdown on the strategy with a 50% winrate. Consequentially, losing streaks will also be much higher for a lower winrate if the same position sizing approach is used.

Although both trading strategies might be profitable over the long-term, short-term variations can lead to impulsive and unnecessary trading mistakes. Amateur traders, especially, are not good at handling drawdowns and the higher the drawdown, the more frequent impulsive trading mistakes will be. Adjusting your position size based on your winrate can prevent unnecessary trading mistakes.

Poker – knowing when to hold them and when to fold them

In poker it is very obvious. Whenever you have a good hand, you want to bet more and when the cards do not look very promising, poker players bet less. Betting the same amount on each individual hand, regardless of the situation, is obviously the wrong thing to do.

Sports betting – Don’t overbet the underdog

In sports betting, gamblers risk more when they bet money on a team that is the clear favorite. Although the underdog still has a chance of winning and at times will even beat the clear favorite. But over the long term, the better team will come out ahead. When a match is tight and the favorite is not as clear, sports bettors will bet less.

By betting more when the odds are in their favor, professional sports bettors can maximize their profits.

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...

8 min read

Dive deep into the world of finance and high-stakes trading with this selection of movies and documentaries! From the exhilarating thrill of...