3 min read

A Year with "The Trading Mindwheel": Transforming Trading Through Psychology

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

Trading is a performance game and there are a lot of similarities between trading and sports. Sports, especially team sports, offers a variety of concepts that can be translated to trading. The mentality, the thought process and the preparation that comes with professional sports illustrates nicely how a trader should approach trading and what to do in order to increase trading performance.

A boxing match usually does not last for more than 1 hour and soccer matches go for 90 minutes. The spectators admire the skills of professional athletes who make it look so easy and effortless. What the spectators don’t get to see is the work that is required to make it look so easy. Professional athletes start their careers when they are still kids and by the time the public gets to see them, they have been practicing daily for years or decades.

“If you fail to prepare, you’re prepared to fail.”– Mark Spitz

Furthermore, professional athletes never stop working on their skills. Each and every day they practice the fundamental concepts in their fields in order to make them even more effectively and efficiently. But professional athletes, not only work on their physical skills, but they also do mental training to create a complete athlete.

Question for yourself: Is your trading routine and the preparation professional? Be honest with yourself and judge how you approach trading.

In sports, every match is different because the opponent changes and each opponent comes with a different skill set, attitude and way of playing. Therefore, in order to maximize your chances of winning, you have to adapt to your specific opponent. You can’t just use the same strategy for every match and expect to win using shortcuts.

In trading, every instrument, timeframe and market has different characteristics. Volatility changes constantly and the way a certain instrument behaves also differs from the trading session, since the traders trading the instruments are different.

To increase your trading performance, monitor closely if certain setups and trading strategies consistently lose on specific instruments or market conditions. The way you set stop loss and take profit orders has to change, based on different market conditions as well. If you want to become a professional trader it is not enough to pick a trading strategy and blindly applying it to different conditions.

Over the course of a season, teams play 10, 20 or 30 different matches and although no one likes to lose, professional athletes know that they don’t have to win every single match in order to be number 1 at the end of a season.

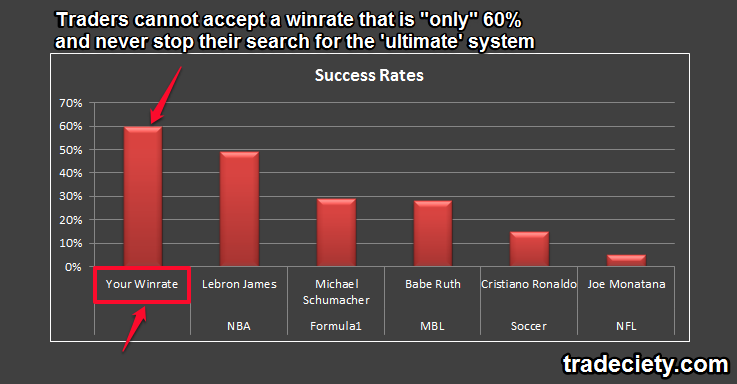

The following graphic illustrates the win rate, hit rate or strike rate of world class athletes in different sports. You can easily see that a hit rate of ‘only’ 50% is not even necessary to be the #1 in any field. Focusing on winrate alone is an amateur mistake because it is absolutely useless when analyzed by itself.

“I’ve missed more than 9,000 shots in my career. I’ve lost almost 300 games. 26 times, I’ve been trusted to take the game winning shot and missed. I’ve failed over and over and over again in my life. And that is why I succeed.” – Michael Jordan

You can be a profitable trader and generate a great income from your trading with a winrate of less than 50%. Whether you can make money as a trader or not depends on a variety of factors, for example, how you use the concept of risk reward ratio, your risk and money management and your mindset – just to name a few.

You would assume that traders know a lot when it comes to position sizing, but you could not be further from the truth. The position sizing strategy of the average trader does not go beyond picking a random number such as 1% or 2% and applying it to every single trade.

People who professionally sport bet know that the odds are very important and they are one of the main factors when it comes to choosing how much to risk. A good sports team will have a higher chance of winning and betters are willing to risk more money on good teams. Gamblers know that by risking more on good teams and risking less on teams with a lower chance of winning, they can achieve very stable results and do not have to deal with large ups and downs in their capital.

Traders would do well to base their position sizing on the actual winrate of a setup. By risking less on trades with a lower winrate you can avoid swings in your account balance and have a more steady account growth.

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...

8 min read

Dive deep into the world of finance and high-stakes trading with this selection of movies and documentaries! From the exhilarating thrill of...