3 min read

A Year with "The Trading Mindwheel": Transforming Trading Through Psychology

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

Whether we look at strong price turning points, trends or support and resistance areas, the concept of supply and demand trading is always at the core of it. It can really pay off it you know our 6 tips for supply and demand forex trading.

A strong uptrend can only exist if buyers outnumber sellers – that’s obvious, right?! During a trend, price moves up until enough sellers enter the market to absorb the buy orders. The origin of strong bullish trends is called an accumulation or a demand zone.

Bearish trends are created when sellers outnumber buy orders. Then, price falls until a new balance is created and buyers become interested again. The origin of a bearish trend wave is called a distribution or a supply zone.

Supply and demand drives all price discoveries, from local flea markets to international capital markets. When a lot of people want to buy a certain item in limited quantity, the price will go up until the buying interest matches the items available. On the other hand, if no one wants to buy a certain item, the seller has to lower the price until the buyer becomes interested or otherwise there won’t be a transaction.

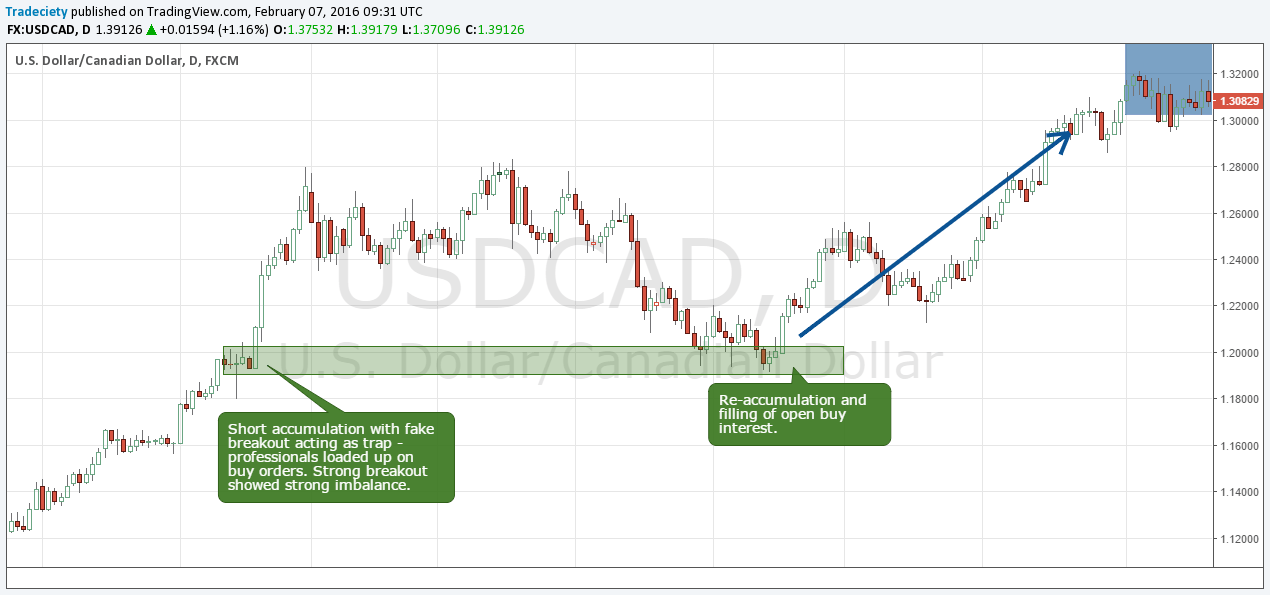

Wyckoff’s “accumulation and distribution” theory describes how trends are created. Before a trend starts, price stays in an “accumulation” zone until the “big players” have accumulated their positions and then drive price higher. They can’t just swamp the market with their full orders because it would lead to an immediate rally and they weren’t able to get a complete fill, thus reducing their profits.

It is reasonably safe to assume that after price leaves an accumulation zone, not all buyers got a fill and open interest still exists at that level. Supply and demand Forex traders can use this knowledge to identify high-probability price reaction zones. Here are the six components of a good supply zone:

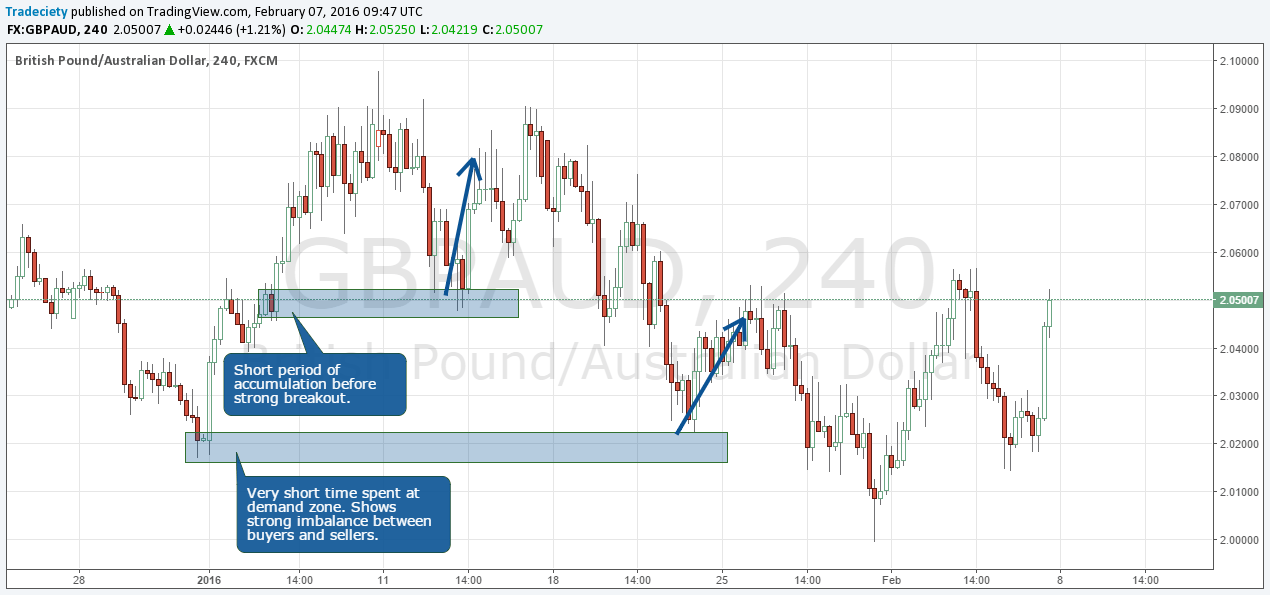

A supply zone typically shows narrow price behavior. Lots of candle wicks and strong back and forth often cancel a supply zone for future trades.

The narrower a supply/demand zone before a strong breakout is, the better the chances for a good reaction the next time typically.

You don’t want to see price spending too much time at a supply zone. Although position accumulation does take some time, long ranges usually don’t show institutional buying. Good supply zones are somewhat narrow and do not hold too long. A shorter accumulation zone works better for finding re-entries during pullbacks that are aimed at picking up open interest.

Good supply zones are somewhat narrow and do not hold too long. A shorter accumulation zone works better for finding re-entries during pullbacks that are aimed at picking up open interest.

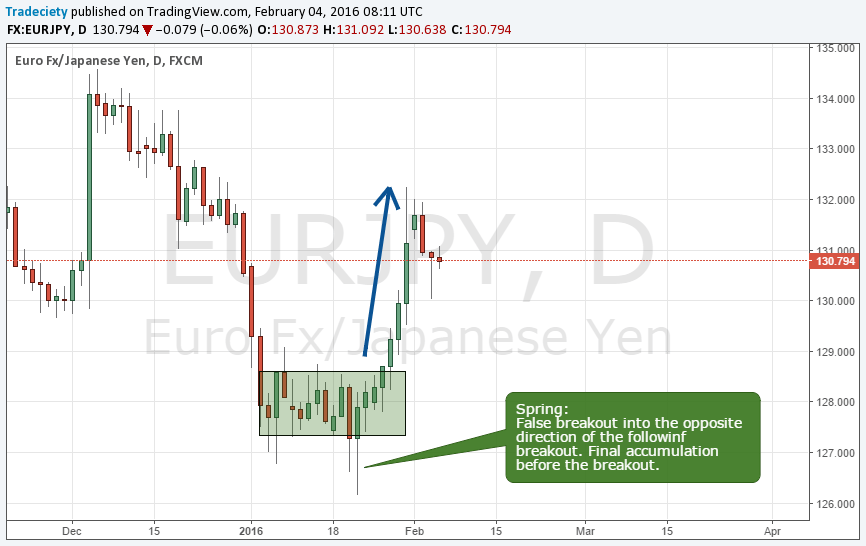

The “Spring” pattern is a term coined by Wyckoff and it describes a price movement into the opposite direction of the following breakout. The spring looks like a false breakout after the fact, but when it happens it traps traders into taking trades into the wrong direction (read more: Bull and bear traps). Institutional traders use the spring to load up on buy orders and then drive the price higher.

This point is important. At one point, price leaves the supply zone and starts trending. A strong imbalance between buyers and sellers leads to strong and explosive price movements. As a rule of thumb, remember that the stronger the breakout, the better the demand zone and the more open interest will usually still exist – especially when the time spent at the accumulation was relatively short.

When price goes from selling off to a strong bullish trend, there had to be a significant amount of buy interest entering the market, absorbing all sell orders AND then driving price higher – and vice versa. Always look for extremely strong turning points; they are often high-probability price levels.

If you trade of supply areas, always make sure the zone is still “fresh” which means that after the initial creation of the zone, price has not come back to it yet. Each time price revisits a supply zone, more and more previously unfilled orders are filled and the level is weakened continuously. This is also true for support and resistance trading where levels get weaker with each following bounce.

The Rally-Range-Drop scenario describes a market top (or swing high), followed by a sell-off. The market top signals a level where the sell interest got so great that it immediately absorbed all buy interest and even pushed price lower.

The amateur squeeze allows good and patient traders to exploit the misunderstanding of how market behavior of consistently losing traders. It is reasonably safe to assume that above a strong market top and below a market bottom, you’ll still find big clusters of orders; traders who specialize in fake breakouts know this phenomenon well.

Most trading concepts sound great in theory, but only if you can actually apply them, it’s worth investing your time and effort to master them. The concept of supply, demand and open interest can be used in 3 different ways:

We at Tradeciety specialize in reversal trading and that’s also the best use for supply and demand zones. After identifying a strong previous market turn, wait for price to come back to that area. If a false breakout occurs, the odds for seeing a successful reversal are extremely high.

To create even higher probability trades, combine the fake breakouts with a momentum divergence and a fake spike through the Bollinger Bands.

Supply and demand zones are natural support and resistance levels and it pays off to have them on your charts for numerous reasons. Combining traditional support and resistance concepts with supply and demand can help traders understand price movements in a much clearer way. You’ll often find supply and demand zones just below/above support and resistance levels. And while the support and resistance trader is being squeezed out of his trade, the supply and demand traders know better.

When it comes to profit placement, supply and demand zones can be a great tool as well. Always place your profit target ahead of a zone so that you don’t risk giving back all your profits when the open interest in that zone is filled. For stops, you want to set your order outside the zones to avoid premature stop runs and squeezes.

I recorded a full and completely free supply and demand trading course on YouTube. Click on the image below to start watching it.

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...

8 min read

Dive deep into the world of finance and high-stakes trading with this selection of movies and documentaries! From the exhilarating thrill of...