3 min read

A Year with "The Trading Mindwheel": Transforming Trading Through Psychology

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

4 min read

Rolf

Dec 22, 2015 7:00:00 PM

Today we will clear up with a few misconceptions about trading which will help you look at your trading and your performance in a new light. The concepts of independence, the illusion of control and exits as functions of your entries are critical to understand when it comes to making the best trading decisions possible.

Independence means that the outcome of a trade does not tell you anything about the potential outcome of your next trade. This means that if you have a losing trade, it’s not more or less likely that your next trade will also be a loser.

The Monte Carlo Fallacy describes that after a long losing streak it is not more likely that you will suddenly strike a winner because it is “overdue”. In truth, the probability for realizing losses and wins doesn’t change after long streaks. If your historical winrate is 60%, even after 10 losers in a row, it’s not more likely to have a winner during the 11th trade – you still have a 60% probability to win a trade.

Rolling die: After having rolled a 6, is it more likely to have another 6 or a 1? Of course, the probabilities never change and the previous roll does not influence the next one. Every time you roll a die, you have the same chances for either of the 6 numbers.

How casinos trick you: In casino roulette computer games, you will always see the last outcomes of the spin on your screen. The reason is that it encourages people to play and bet more because when they see that red won the last 5 times, they believe that black is overdue or that the roulette wheel likes red more. Casinos know about the psychological weaknesses of people.

Lessons for traders: Don’t become too confident during winning streaks and do not become scared during losing streaks. Furthermore, don’t expect a long streak to end just because you think it has to. However, the premise is that losing streaks are not caused by mistakes and that you follow your system 100%. Never deviate from the plan and always follow your system, every streak will end sooner or later – it’s just how statistics work.

What is the probability of having a winning trade next for the 3 scenarios?

| Scenario 1 (winrate 60%) | Scenario 2 (winrate 60%) | Scenario 3 (winrate 60%) |

| Winner | Winner | Loser |

| Loser | Winner | Loser |

| Winner | Winner | Loser |

| Loser | Winner | Loser |

| ?? | Winner | Loser |

| Winner | Loser | |

| ?? | ?? |

(the answer is at the end of the article)

There are a variety of very interesting and surprising experiments around the illusion of control in events with random outcome:

Psychology found that a feeling of control not only makes us feel better, but it also makes us healthier. 5

Of course, in trading, the illusion of control can lead to a variety of misconceptions and trading mistakes. Placing a trade yourself, after having done your own analysis and coming up with the conclusion that the setup looks good, creates the illusion that we only (mostly) pick winning trades – why would we enter a losing trade anyways, right?! This then leads to emotional attachment and the inability to cut losses.

This point is more of a mathematical misconception and misinterpretation rather than a statistical concept by itself. When expressing your trade in terms of reward-risk, don’t use the ratio to justify a trade decision.

If you say that your trade has a large reward-risk ratio of 4:1 and that you only have to be right 20% of the time for such a trade, it does not automatically mean that you should take that trade. Does it fit into your rules? Are all your criteria met? Have you placed the stop in a reasonable way or did you choose your stop loss so that it gives you a certain reward-risk ratio?

A manager that has become overconfident by using a bad process is like somebody who plays Russian roulette three times in a row without the gun going off, and thinks they’re great at Russian roulette. The fourth time, they blow their brains out. – Daniel Loeb

A reward-risk ratio is just that – a ratio. And it does not say anything about the trade itself, how good the trade is and how likely you will have a winner. Never use the size of your reward-risk ratio to justify a trade entry. The only thing you can control about our trade is the downside and the risk; you have no control about the potential upside.

Don’t let your exit be a function of your entry and stop. – Jim Paul

Trading is all about math and statistical [download our math cheat sheet] concepts. However, most traders lack a basic understanding about the most common mathematical principles which then leads to trading mistakes most are not even aware they are making.

This article explains the most commonly made mistakes when it comes to statistical principles in trading. The following points sum up the findings:

Answer to the question in this article: 60%! The likelihood never changes based on past results. Past results do not influence future results.

References:

3 min read

The following is a guest post from Michael Lamothe.

I'm Michael Lamothe, and today marks an extraordinary milestone: the first anniversary of "The...

3 min read

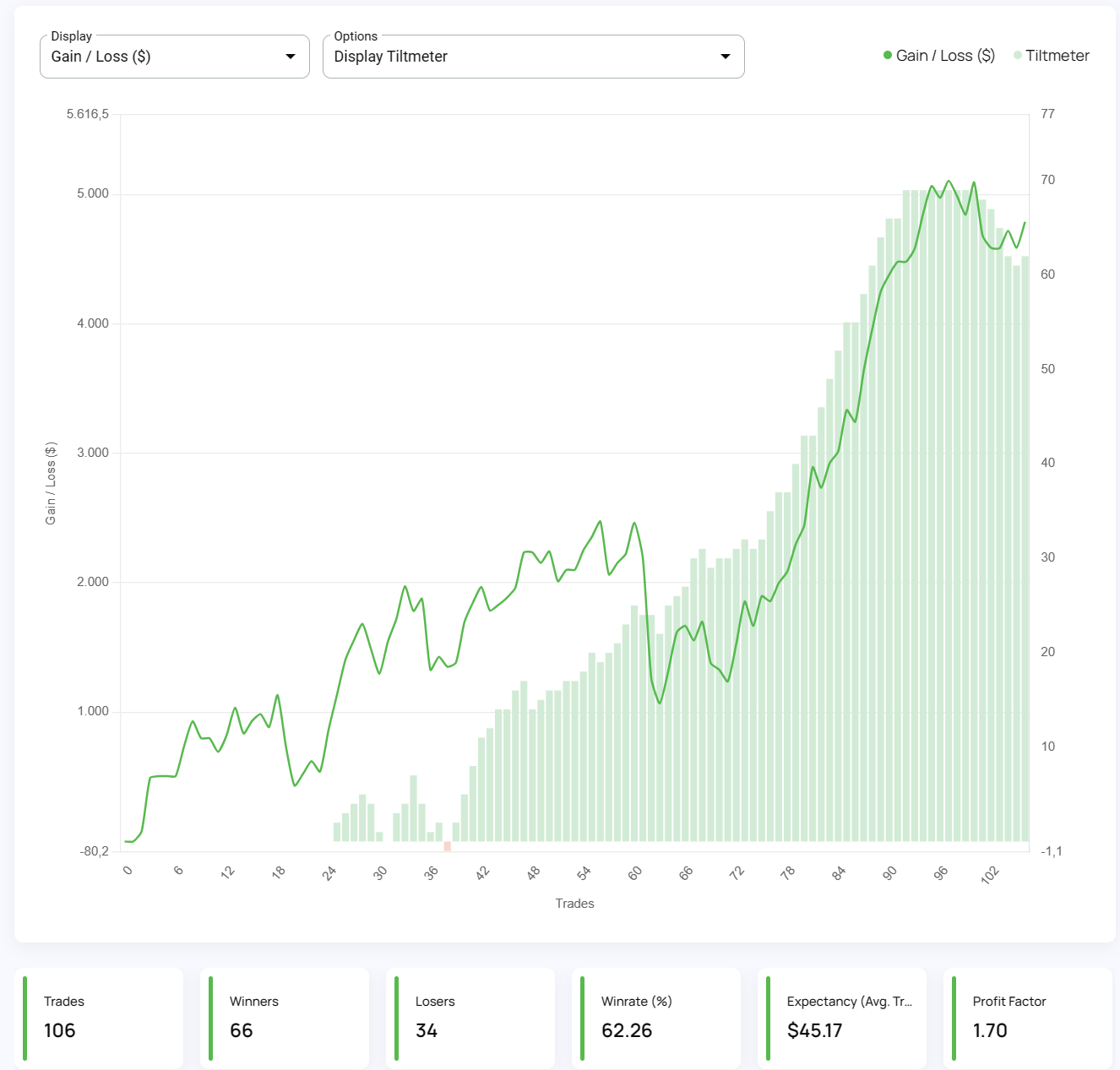

It's easy to get discouraged by losses and question your every move. But what if there was a way to track your progress, learn from mistakes, and...

8 min read

Dive deep into the world of finance and high-stakes trading with this selection of movies and documentaries! From the exhilarating thrill of...